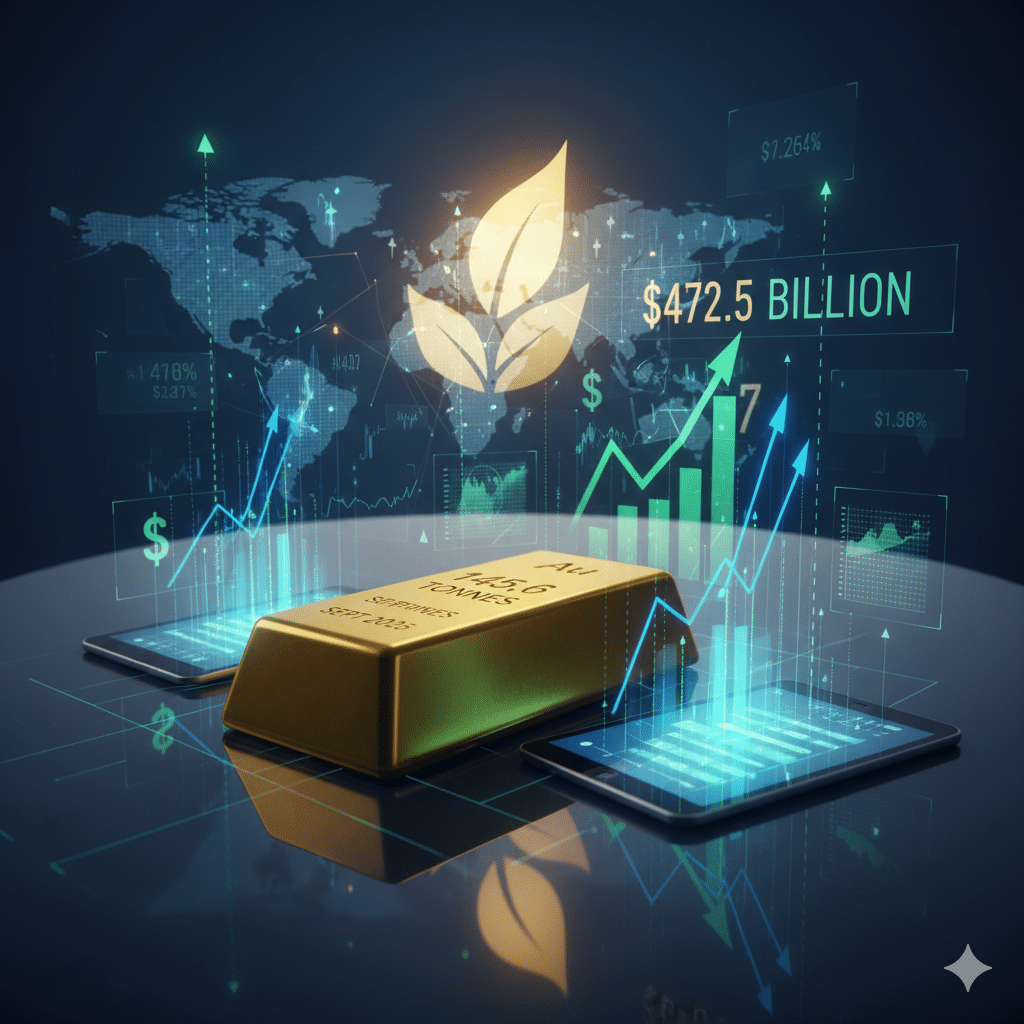

Gold exchange-traded funds (ETFs) witnessed an unprecedented increase in holdings during September 2025, according to a recent report by the World Gold Council (WGC). The global value of gold held within these funds soared by a record-breaking $17.3 billion, equating to a substantial 145.6 tonnes of gold. This monumental rise underscores a renewed investor confidence in the precious metal.

The significant upturn was largely driven by a sharp appreciation in gold prices towards the end of the month, coupled with a robust influx of new investments into the funds. This combined effect propelled the total value of gold held in global ETFs to an impressive new peak of $472.5 billion.

In terms of volume, the 3,837.7 tonnes of gold now held in ETFs brings the market tantalizingly close to its all-time high, previously recorded in the autumn of 2020. This near-record level highlights gold’s enduring appeal as a safe-haven asset amidst ongoing economic uncertainties and inflationary pressures.

Analysts suggest that the surge reflects growing investor apprehension regarding global economic stability, prompting a shift towards tangible assets like gold. The accessibility and liquidity offered by ETFs make them a preferred vehicle for many looking to gain exposure to gold without the complexities of physical ownership.

The WGC’s data paints a clear picture of a thriving gold ETF market, demonstrating gold’s continued relevance in diversified investment portfolios. As global economic landscapes continue to evolve, the yellow metal’s role as a store of value appears to be stronger than ever, with September’s performance serving as a testament to its enduring allure.