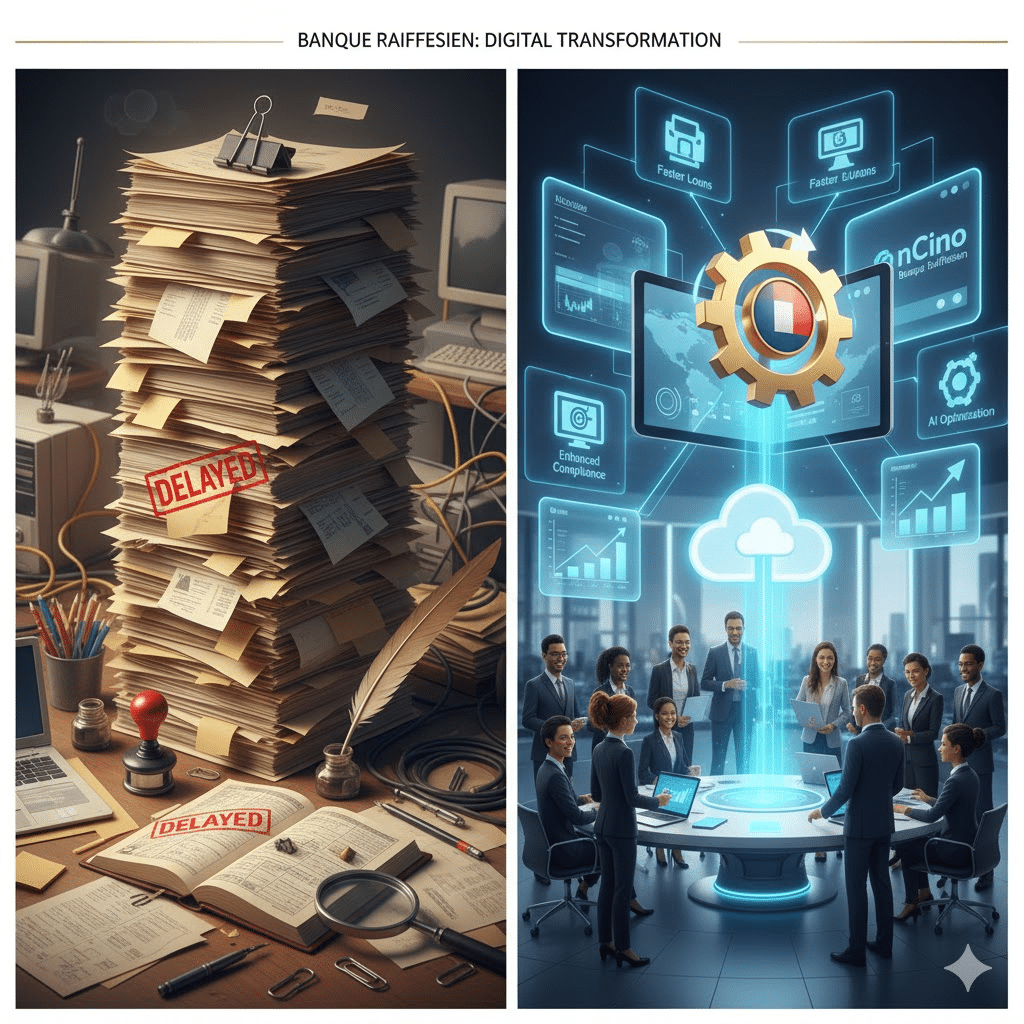

Banque Raiffeisen, one of Luxembourg’s oldest and most trusted cooperative banks, established in 1926, is undergoing a major digital transformation by partnering with nCino, a global leader in cloud banking solutions. This move signals the bank’s transition from decades of paper-heavy, manual workflows to a streamlined, modern, and compliant digital credit operation.

The Challenge: Ditching the Paper Trail

Despite its long-standing focus on “customer-first values” and “solid governance,” Banque Raiffeisen’s reliance on paper-based workflows was identified by internal audits and regulators as a critical barrier to efficiency and a source of compliance risk.

The primary objective of the partnership is to “remove paper and digitalise the entire chain—from customer application to back-office processing through the full lifecycle of credit,” according to Programme Manager Clément Loubeyres.

The Decision: Partnering over Building In-House

The bank’s leadership faced a fundamental “build or buy” decision. While the IT department initially favored developing a solution internally, the business teams pushed for an experienced external partner.

After a thorough comparison of market alternatives, Banque Raiffeisen ultimately chose nCino. This decision was driven by the desire to adopt “standard processes created by a solution made for credit granting” rather than recreating their complex, customized existing system. Loubeyres advises other institutions to make this strategic choice clear at the start of any transformation project.

Key Benefits and Future Plans

The project is being rolled out in phases, starting with retail mortgages and later expanding to commercial lending. The expected benefits are comprehensive and far-reaching:

- Efficiency: Complete elimination of manual, paper-based processes.

- Customer Experience: Improved turnaround time from application to loan offer.

- Compliance & Standardization: Enhanced adherence to regulations and standardized processes across departments.

- Insight: Advanced real-time reporting capabilities achieved by decoupling credit data from the core banking system.

Looking ahead, Banque Raiffeisen views the nCino partnership as “definitely long-term.” The bank is already exploring the integration of Artificial Intelligence (AI), specifically for document classification, to further reduce manual workloads and accelerate decision-making, setting a new benchmark for credit management in the Luxembourg banking landscape.